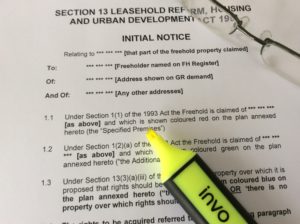

THE ENFRANCHISEMENT NOTICE – WHAT IT MEANS AND WHAT THE FREEHOLDER’S OPTIONS ARE

The Lease Enfranchisement Notice – what is it?

The Enfranchisement Notice [often referred to as a Section 42 notice] is the first piece of legal documentation you will have to deal with on your journey towards buying the freehold of your block of flats, or the freehold purchase of your leasehold house. It’s also the most important.

The Enfranchisement Notice essentially notifies the landlord that the participant leaseholders wish to purchase the freehold of their block of flats and makes a financial offer for the freehold.it is the 1st step in what is known as statutory enfranchisement – as distinct from informal or voluntary enfranchisement where no notice is required, there are no deadlines and the freeholder can simply choose to drop out of any stage.

The notice is required by law, although there is no prescribed form to be used. This is just one of a number of reasons why specialist legal advice is highly recommended.

NB if the enfranchisement takes place as a result of the Right of 1st Refusal, the process is different. There is no section 42 notice, and instead the sale is started by the freeholder serving what is known as a section 5 notice.

Our team have the specialist Enfranchisement expertise you need? Call us now on FREEPHONE 0800 1404544 for FREE Initial Phone Advice.

What should the Notice contain?

Certain information must be included in the notice;

· the name and address of the nominee purchaser

· the property being enfranchised

· the offer price for buying the freehold

· the names, signatures and addresses of all of the residents and participants in the enfranchisement process [in particular the notice cannot be signed by a Power of Attorney, lawyer or any other person, or it will be declared invalid – see below].

Provided all of this information is supplied properly, the Enfranchisement Notice should be deemed legal and official. This also begins the series of legal deadlines which must be adhered to by both parties in order to keep the whole lease enfranchisement process on track.

NB 1 of the biggest problems with buying the freehold of your building, especially with larger blocks, is not only getting the support of enough leaseholders to start the process, but also keeping those leaseholders on board throughout what can be quite a slow and convoluted process. The answer is a participation notice – which would normally be prepared and signed before the enfranchisement notice.

Click here to read more about the Enfranchisement Participation Agreement and how it could help you

Getting the right signatures on the notice

It is a legal requirement that all of the participating residents sign the Enfranchisement Notice and Participation Agreement personally. This must NOT be done by another person on behalf of them, even a person with legal power of attorney. The personal signature of every participant resident must be obtained or the Enfranchisement Notice can be declared invalid in court by the landlord and your entire collective enfranchisement effort will end immediately.

This is by far one of the easiest mistakes you can make. Why?

Because what counts as as a participant resident can differ from what you’d imagine.

If, for example, a flat is owned by more than one person, then each individual must sign both documents personally. The documents should not be dated, though. The documents are best emailed to all participants with a cover notice to show them what will be arriving and to invite any questions or queries. The documents should then be sent by registered mail with a reminder that they cannot be altered and must personally be signed by the residents themselves. By having them sent by registered mail the organiser should be able to track the documents being sent from one participant to the next, and both documents should always be sent together.

This is yet another reason why you need a specialist solicitor when it comes to buying the freehold of your block.

Getting the Enfranchisement Notice wrong – the consequences

Legal advice should be sought in drawing up an Enfranchisement Notice as a great number of enfranchisement attempts fall at the first hurdle because the Enfranchisement Notice is deemed to be invalid.

If this happens, you will have to wait a full calendar year before beginning the whole process again – so you should seek the advice of the relatively few solicitors who really understand collective enfranchisement who can help you to draw up an Enfranchisement Notice.

And having to wait at least a year before restarting the freehold purchase bid can prove disastrous. Firstly, in a rising property market, the value of the building may have increased, but as importantly, you may find it difficult, especially with medium-size and large rocks, to keep all of the participating leaseholders on board for a further 12 months. And not having enough l easeholders on board means no chance of successful enfranchisement.

There are a number of loopholes which some freeholders use in order to declare the notice invalid and great care should be taken to avoid these.

Declaring the invoice Enfranchisement Notice invalid

Should your freeholder wish to declare your Enfranchisement Notice invalid, he or she must make a claim at the County Court against the nominee purchaser, asking the court to declare the notice invalid. At this point, the whole enfranchisement process is put on hold and you cannot proceed to the third phase without the issue being resolved and the County Court confirming the notice was valid, allowing you to carry on with the process.

On what basis can the freeholder have the enfranchisement notice declared invalid?

There are a number of grounds on which a freeholder can have an Enfranchisement Notice declared invalid -which ends the collective enfranchisement process at the first hurdle. The most common successful objections include the following;

• a single participant having not signed the Notice or it having been signed by a representative or Power of Attorney. The leaseholder must sign it personally for it to be valid. This is absolutely essential and something that’s particularly important to watch for in big blocks, where sometimes up to hundred or more individual signatures are required. Missing just a single one could allow the freeholder to have the notice declared invalid

• The Enfranchisement Notice must also correctly and fully identify every leaseholder in the building. This can be done by carrying out a search at HM Land Registry.

• The offer price contained in the Enfranchisement Notice must also be deemed realistic and fair. That’s why it’s so important to get an experienced enfranchisement surveyor on as part of your team, to make sure your offer is reasonable. A stupidly low offer can result in the notice being declared invalid.

What is a counter notice?

Alternatively, if the freeholder accepts that the notice is OK, they may serve a Counter Notice.

This is an official reply to the Enfranchisement Notice and it will often include a counter offer – where the freeholder offers a reduced figure which he would accept to sell the freehold.

If this Counter Notice is not served by the deadline identified in the Enfranchisement Notice (usually two months), the leaseholders are legally entitled to buy the freehold at the offer price they initially made in the Enfranchisement Notice.

That’s why virtually all freeholders make sure they have a specialist solicitor on board – they understand the risk of getting the Counter Notice wrong.

Tactics – is it worth offering the freeholder a rock bottom price?

It’s worth noting that offering an unrealistically low price for the freehold in the hope that your freeholder may not respond is not recommended.

Why? as indicated above, the freeholder could have the notice declared invalid if the offer price is deemed unreasonably low by the County Court.

Counter notice – what happens if the counter offer is ludicrously high?

If a counter offer is received and is unrealistically high, the leaseholders also have a right to challenge this. This cannot be done through the County Court, though, nor can it be declared invalid.

The matter must be passed to the First-Tier Tribunal – Property Chamber (Residential Property) (previously known as the Leasehold Valuation Tribunal or LVT) asking for a hearing to be held to decide the correct valuation of the freehold purchase.

The freeholder may also declare that they consider the claim to be invalid based on it not meeting the basic qualifying criteria – in which case he or she must state the reasons for their belief that those looking to exercise their right to enfranchise do not meet these criteria.

Don’t forget Outbuildings and Garages

If you haven’t done your homework, going through the collective enfranchisement process can be difficult. When you make your first offer in the Enfranchisement Notice there are a lot of variables which have to be taken into account, and it is a common mistake to forget about garages, gardens and other grounds around the property.

A block of flats isn’t just the building with the apartments inside, and all of the additional grounds and areas which are part of the freehold have to be taken into account when applying to buy the freehold.

Should the other areas be included in an Enfranchisement Notice?

The right to enfranchise may also grant leaseholders the opportunity to buy gardens, surrounding property and garages associated with the property and this is something that you should think about when you are putting together an offer to buy the freehold.

Additional areas could include walkways or paths, parking spaces or forecourts, and these areas are known legally as “appurtenant property”. If you are planning to buy this appurtenant property as part of the deal, this has to be stated clearly in the first Enfranchisement Notice.

If you do want to buy the appurtenant property then this has to be explicitly stated in the Enfranchisement Notice. Getting everything stated clearly in the Enfranchisement Notice will avoid the possibility of misunderstandings or delays in the legal process further down the line.

What about the garage?

If the lease on your flat includes a garage, then you have the legal right to force your freeholder to sell this as well when exercising your rights to buy the freehold. The garage and the flat are legally linked together, and if the leaseholder decides they want to buy the garage as part of the enfranchisement, then the freeholder has to sell it.

If the garage and the flat are not legally linked, but the lease for both is held by the same person, then again the leaseholder has the legal right to buy the freehold for the garage as well as the freehold for the flat. Legally, the garage is considered to be enfranchisable separately, and the leaseholder can buy the freehold of the garage separate from any collective freehold purchase should they wish to do so.

Don’t be tempted to assume that the ownership is obvious without checking the documents held by the Land Registry. Leasehold titles can be downloaded from the Land Registry website, or you can apply for them by post by completing an OC1 form.

What is property enfranchisement?

Property enfranchisement allows long leaseholders to collectively buy the freehold of their building from their landlord. Provided the leaseholders fulfil the applicable legal criteria and follow the correct procedure, they can effectively force the landlord to sell the building to them.

Can the landlord refuse enfranchisement?

Provided you fulfil the legal criteria and follow the correct procedure, the landlord cannot generally refuse enfranchisement. Accordingly, ensuring you understand the eligibility requirements and follow the right procedure is crucial. There are some limited circumstances in which a landlord can refuse enfranchisement, such as if they intend to demolish and redevelop the building and at least two-thirds of the leases will terminate within the next 5 years.

How do you qualify for enfranchisement?

To qualify for enfranchisement, you must have a long lease, which is one that was initially granted for at least 21 years, own no more than two flats in the building, and not be a business tenant. Further criteria apply to the building itself, including that it is self-contained and no more than 25% of its floor space is used for non-residential purposes.

What are the benefits of enfranchisement?

Enfranchisement has several benefits. They include gaining maximum control of your building and how it is managed, increasing the value and saleability of your property, and extending your lease without having to pay a premium.

Enfranchisement is complicated – that’s why you need specialist advice

The whole process of buying the freehold to your block can be quite tricky especially if the legal team representing your freeholder tries to exploit loopholes or legal technicalities to stop your Enfranchisement Notice dead in its tracks.

It is for this reason, amongst many others, that it is highly recommended that you seek the advice of a solicitor who specialises in collective enfranchisement and leasehold extensions.

Without the right legal advice, you could find yourself with a big legal bills and the enfranchisement process over before it’s even begun – which isn’t a risk worth taking.

Don’t risk drafting your own enfranchisement notice – Call our specialists today

For specialist legal advice on buying the freehold of your block, contact our specialist team now.

- Call us on FREEPHONE 0800 1404544 for FREE initial phone advice on your options or

- Complete the contact form below